Investing in jewelry can be a rewarding endeavor, combining the pleasure of owning beautiful pieces with the potential for financial growth. Whether you’re a seasoned investor or a novice looking to diversify your portfolio, understanding the nuances of the jewelry market is essential. Here’s a comprehensive guide on how to invest in jewelry wisely.

- Understand the Market

Research and Education:

- Before making any investments, it’s crucial to educate yourself about the jewelry market. Learn about different types of jewelry, precious metals, gemstones, and the factors that influence their value.

- Follow market trends, attend jewelry exhibitions, and read industry publications to stay updated.

Know the Value Factors:

- The value of jewelry is determined by several factors, including rarity, craftsmanship, condition, and provenance. Understanding these factors will help you make informed investment decisions.

- Focus on Quality and Craftsmanship

High-Quality Materials:

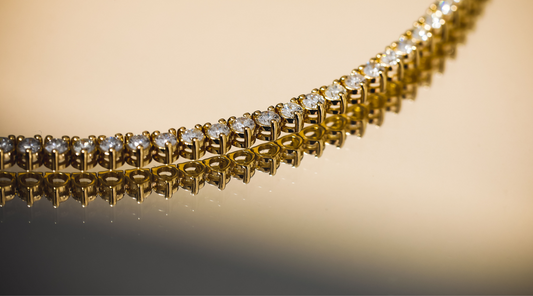

- Invest in jewelry made from high-quality materials such as gold, platinum, and high-carat gemstones. These materials not only retain their value but often appreciate over time.

Craftsmanship:

- Exquisite craftsmanship can significantly enhance the value of a piece. Look for intricate designs, flawless execution, and attention to detail.

- Diversify Your Collection

Types of Jewelry:

- Diversify your investment by acquiring different types of jewelry, including rings, necklaces, bracelets, and earrings. This spreads risk and increases the likelihood of appreciating value.

Vintage and Antique Pieces:

- Vintage and antique jewelry often have historical significance and unique designs, making them valuable investments. Ensure they are in good condition and come with proper documentation.

Gemstones:

- Invest in a variety of gemstones such as diamonds, sapphires, rubies, and emeralds. Each gemstone has its own market dynamics and potential for appreciation.

- Authenticate and Appraise

Authenticity:

- Ensure that the jewelry you purchase is authentic. Work with reputable dealers and ask for certificates of authenticity, especially for high-value items.

Appraisals:

- Get your jewelry appraised by certified gemologists. An appraisal provides an official valuation, which is essential for insurance and resale purposes.

- Storage and Maintenance

Proper Storage:

- Store your jewelry in a safe, dry place to prevent damage. Use jewelry boxes with individual compartments to avoid scratches and tangling.

Regular Maintenance:

- Regularly clean and inspect your jewelry to maintain its condition. For high-value pieces, consider professional cleaning and servicing.

- Insurance and Documentation

Insurance:

- Insure your jewelry against theft, loss, and damage. This protects your investment and provides peace of mind.

Documentation:

- Keep detailed records of your jewelry, including purchase receipts, appraisals, certificates of authenticity, and photographs. This documentation is crucial for insurance claims and resale.

- Buy from Reputable Sources

Established Dealers:

- Purchase jewelry from established and reputable dealers, auction houses, and galleries. These sources are more likely to offer authentic and high-quality pieces.

Avoid Impulse Buys:

- Avoid buying jewelry on impulse, especially from unknown or unverified sources. Take your time to research and verify the authenticity and value of the piece.

- Consider the Long-Term Perspective

Long-Term Investment:

- Jewelry should be viewed as a long-term investment. While some pieces may appreciate quickly, others may take time to increase in value.

Market Fluctuations:

- Be aware that the jewelry market can fluctuate. Stay patient and informed about market trends to make the most of your investment.

Conclusion

Investing in jewelry requires careful consideration, research, and a long-term perspective. By focusing on quality, diversifying your collection, ensuring authenticity, and maintaining proper storage and documentation, you can build a valuable jewelry collection that appreciates over time. Remember, the joy of owning exquisite jewelry goes hand-in-hand with the potential financial rewards, making it a uniquely fulfilling investment.